The Best Strategy To Use For Pacific Prime

Table of ContentsThe Basic Principles Of Pacific Prime The Basic Principles Of Pacific Prime Some Known Questions About Pacific Prime.Pacific Prime Things To Know Before You Get ThisThe 6-Minute Rule for Pacific Prime

Insurance is a contract, represented by a policy, in which an insurance policy holder obtains monetary security or repayment against losses from an insurance policy firm. A lot of individuals have some insurance coverage: for their car, their residence, their health care, or their life.Insurance likewise assists cover expenses connected with responsibility (legal duty) for damage or injury created to a 3rd event. Insurance policy is an agreement (plan) in which an insurance firm compensates another against losses from particular contingencies or hazards. There are several types of insurance coverage policies. Life, health and wellness, property owners, and car are amongst one of the most usual kinds of insurance.

Investopedia/ Daniel Fishel Numerous insurance policy kinds are readily available, and essentially any individual or business can discover an insurance firm ready to guarantee themfor a price. Typical personal insurance plan types are automobile, wellness, homeowners, and life insurance policy. Most people in the United States have at the very least one of these kinds of insurance policy, and auto insurance coverage is called for by state legislation.

Little Known Facts About Pacific Prime.

Finding the price that is ideal for you calls for some research. The plan restriction is the optimum amount an insurance firm will certainly pay for a protected loss under a policy. Optimums might be established per period (e.g., yearly or plan term), per loss or injury, or over the life of the policy, additionally recognized as the lifetime optimum.

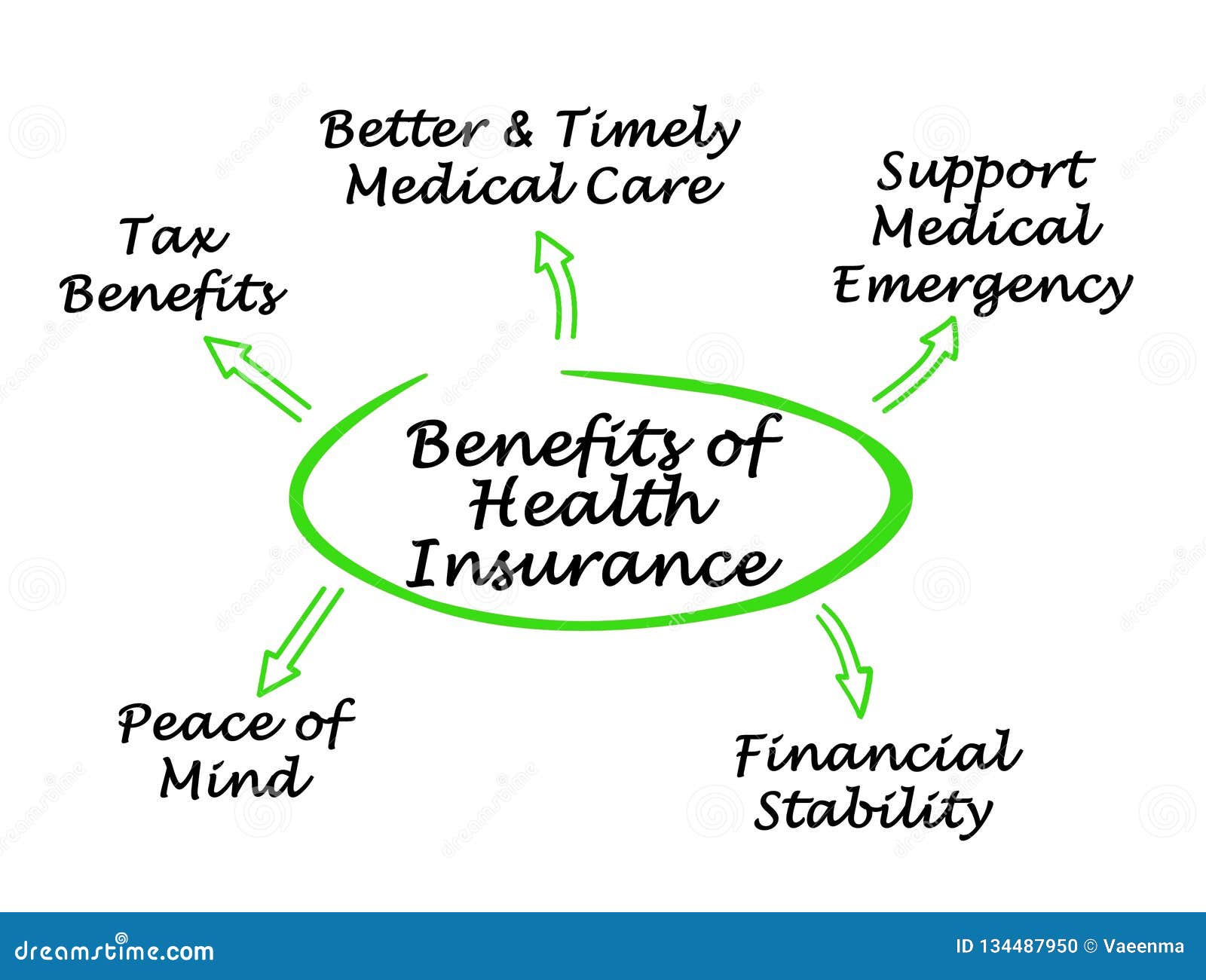

There are lots of different kinds of insurance. Wellness insurance policy helps covers regular and emergency situation clinical treatment expenses, commonly with the option to add vision and oral services independently.

Nevertheless, many preventative solutions might be covered for complimentary before these are satisfied. Medical insurance might be bought from an insurer, an insurance coverage agent, the government Health Insurance Market, offered by a company, or government Medicare and Medicaid insurance coverage. The federal government no longer needs Americans to have health insurance policy, but in some states, such as California, you might pay a tax penalty if you don't have insurance.

What Does Pacific Prime Mean?

The company after that pays all or most of the covered costs associated with a vehicle mishap or other automobile damages. If you have a rented automobile or borrowed cash to purchase a cars and truck, your lender or renting dealership will likely need you to lug automobile insurance policy.

A life insurance plan guarantees that the insurer pays an amount of cash to your beneficiaries international travel insurance (such as a spouse or youngsters) if you die. There are 2 main kinds of life insurance coverage.

Permanent life insurance coverage covers your entire life as long as you proceed paying the premiums. Traveling insurance covers the expenses and losses related to taking a trip, including trip cancellations or hold-ups, insurance coverage for emergency health and wellness treatment, injuries and discharges, harmed baggage, rental cars, and rental homes. Nonetheless, even a few of the best travel insurance business - https://www.webtoolhub.com/profile.aspx?user=42386420 do not cover terminations or hold-ups due to weather, terrorism, or a pandemic. Insurance coverage is a way to manage your financial risks. When you acquire insurance coverage, you purchase security against unexpected financial losses.

The Basic Principles Of Pacific Prime

There are numerous insurance coverage plan types, some of the most usual are life, health and wellness, home owners, and automobile. The best type of insurance coverage for you will depend on your goals and monetary situation.

Have you ever before had a moment while checking out your insurance coverage or purchasing insurance coverage when you've thought, "What is insurance policy? And do I really require it?" You're not alone. Insurance can be a strange and confusing thing. Exactly how does insurance policy work? What are the benefits of insurance policy? And how do you discover the best insurance coverage for you? These are typical questions, and thankfully, there are some easy-to-understand solutions for them.

Nobody desires something bad to happen to them. Experiencing a loss without insurance coverage can place you in a tough economic scenario. Insurance coverage is a vital financial tool. It can assist you live life with less concerns knowing you'll get monetary aid after a calamity or mishap, aiding you recover much faster.

Pacific Prime Fundamentals Explained

And sometimes, like auto insurance coverage and workers' compensation, you might be needed by law to have insurance in order to protect others - group insurance plans. Learn more about ourInsurance choices Insurance coverage is essentially a big stormy day fund shared by many individuals (called policyholders) and handled by an insurance carrier. The insurance provider uses cash collected (called costs) from its policyholders and other financial investments to spend for its operations and to meet its promise to policyholders when they file a case